Taxes Profiles

Section overview

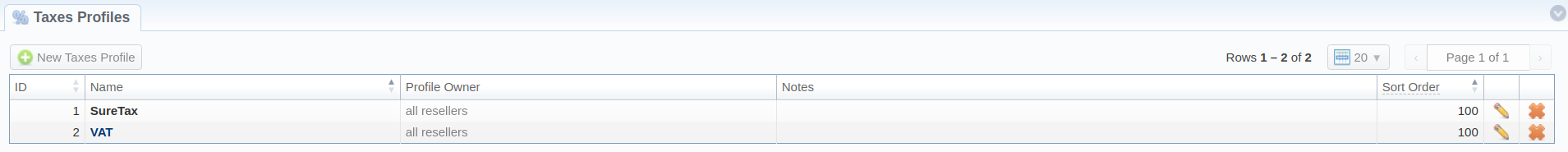

Taxes profiles are a set of tax rules that can be applied to client's rate tables in different taxation schemes. This section allows you to add, edit, and delete profiles and is presented in the form of a table with the following columns:

| Column | Description |

|---|---|

| ID | Taxes profile's identification number |

| Name | Name of a taxes profile (clickable, to access taxation values for "Internal" type profile) |

| Profile Owner | List of resellers corresponding taxes profile was assigned to |

| Notes | Additional information regarding a taxes profile |

| Sort Order | Order of the entity in the list |

Functional buttons/icons, presented in the section, are as follows:

| Button/Icon | Description |

|---|---|

| Allows to create a new taxes profile |

| Allows to manage an existing taxes profile on a list |

| Allows deleting a taxes profile from the system. Requires confirmation |

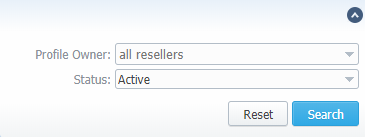

Advanced search

In the top right corner of the section above the table, an advanced search drop-down menu is located. By clicking on a blue downward arrow icon, a drop-down menu with the following structure is displayed:

| Field | Description |

|---|---|

| Profile Owner | Select from the list of all Resellers and Sub-resellers registered in the system |

| Status | Select the status of a taxes profile: "Active", "Archive" |

To apply the specified search criteria, click the Search button; to cancel the applied parameters, click the Reset button.

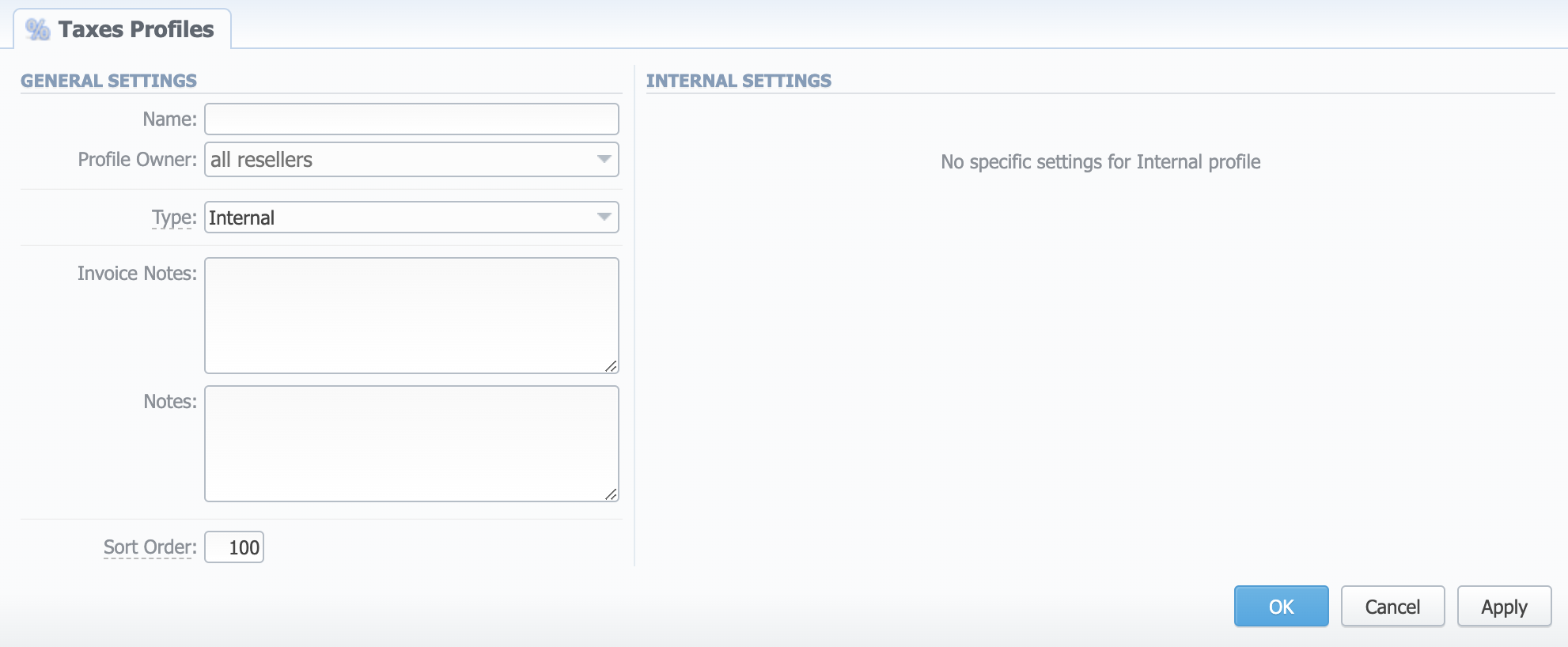

Creating a new Taxes Profile

To create a new profile, you need to:

- Click the New Taxes Profile button

- Fill in mandatory fields

- Click the "OK" button

You can select the type of a taxes profile while creating a profile:

- Internal

- SureTax

- Compliance Solutions

- Avalara

Please note that you cannot change the taxes profile type after creation.

Type: Internal

| Field | Description |

|---|---|

| Name | Name of a taxes profile |

| Profile Owner | Select from the list of all Resellers and Sub-resellers registered in the system |

| Type | Select the tax profile type from a drop-down list |

| Invoice Notes | If specified, this information will be displayed in issued Invoices |

| Notes | Additional information regarding a taxes profile |

| Sort Order | Order of the entity in the list |

JeraSoft Billing is integrated with three third-party tax calculation engines: Avalara, Compliance Solutions, and SureTax. Please find more information on those tax profiles' parameters here.

Tax Values Management

While using "Avalara", "SureTax", or "Compliance Solutions" profile type, the tax values cannot be managed manually in the system as the taxes will be automatically dipped from third-party tax calculation services. Only the "Internal" profile allows managing the tax values.

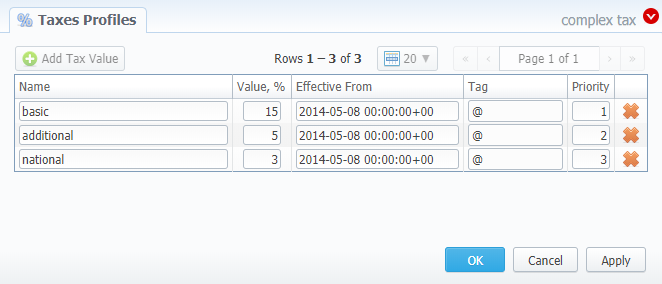

To manage a tax value within the taxes profile, you need to click the respective profile name. In the pop-up window, you can add a new rule by clicking Add Tax Value or edit already existing values. The structure of a pop-up window is as follows:

| Field | Description |

|---|---|

| Name | Name of the tax value added to this profile |

| Value | Specify a tax value in % |

| Effective from | Start date of a corresponding tax value |

| Tag | Specify tag(s) you would like to be applied to corresponding tax value. If no tags are added, you can leave the field blank |

| Priority | Specify the priority of tax value usage |

While operating with tax values, you can apply advance search to find the value you might be interested in. To do so, click on a red downward arrow icon in the top right corner of the pop-up window and set the Status and Date fields:

Status:

- current on - if chosen, all tax values with the latest Effective from field value will be displayed

- old for - if chosen, all tax values, whose Effective from field value is older in comparison to its current one, will be displayed

- future for - if chosen, all tax values, whose Effective from field value > Date, will be displayed

- all - if chosen, all tax values will be displayed

Date - set the time and date that will be applied for the search.

By default, tax values displayed in a pop-up window are filtered by the "current on" status.

In cases when you determine a Priority status, you basically set the order of the taxation. So, the tax with Priority 1 will add % tax to operation sum, the tax with Priority 2 will add tax % to the resulted sum (operation sum + 1st tax %). Each following priority will add % tax to operation sum plus all the previous priorities values.

For example:

If operation sum is 100 USD, and there is a single tax with Priority 1 and a value of 10%, the taxation result will be 10 USD, so full operation plus tax is 110 USD.

If there are two taxes with priorities of 1 and 2, and values of 10% and 20%, respectively, then the first tax yield will be 10 USD, and second tax yield will be 22 USD (because 20% is calculated from sum of operation + previous tax), and total will be 100 + 10 + 22 = 132 USD.

You cannot delete or archive a tax profile that is currently assigned to the Client, Call Shop, or Reseller.