US Taxation

The US taxation deals with around 35,000 sales and telecom tax jurisdictions, the number of which continues to grow. In order to make sure your tax calculations meet the required law standards, JeraSoft has introduced the integration with three third-party tax calculation services:

- SureTax

- Compliance Solutions (since JeraSoft Billing v3.21.0)

- Avalara (since v3.23.3)

warning

Please make sure you have an account with SureTax, Compliance Solutions or Avalara service to be able to connect it to JeraSoft Billing.

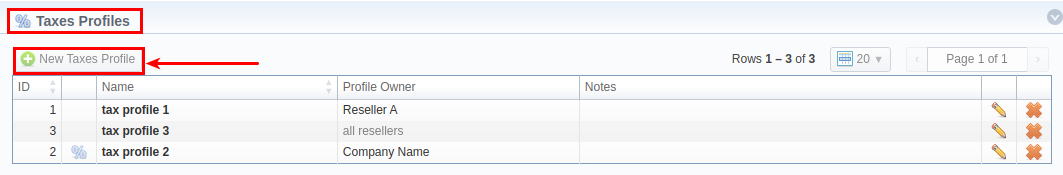

Creating a Taxes Profile

- Go to Configuration → Taxes Profiles section and create a new Taxes Profile by clicking the button "New Taxes Profile".

- Fill in mandatory fields in the creation form, which differ depending on the Taxes Profile type. See more in the User Guide article for Taxes Profiles.

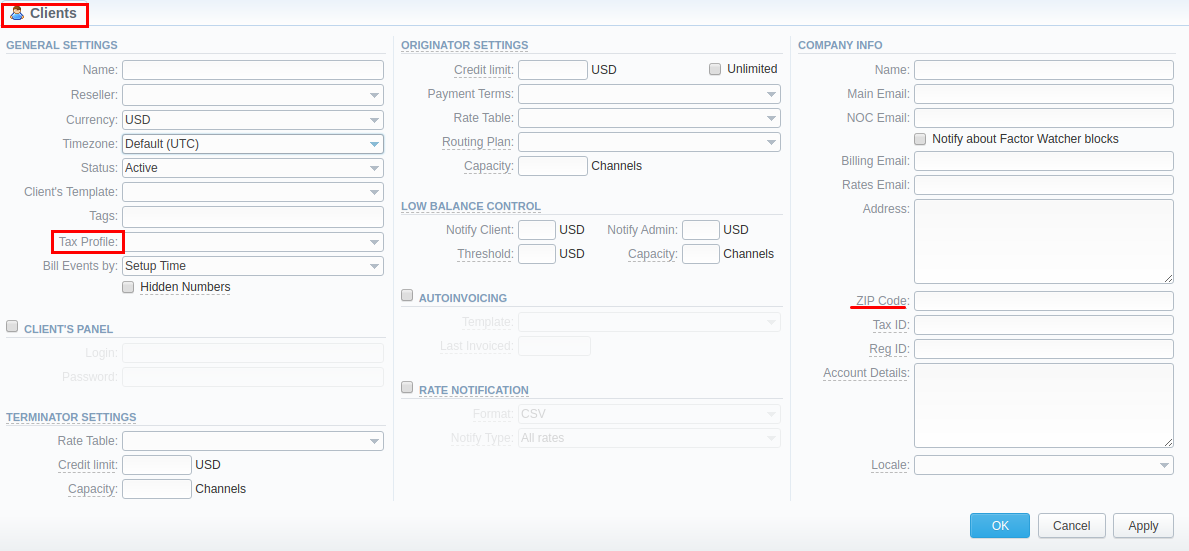

Assigning a Taxes Profile to a Client

- Go to Management → Clients and assign a Tax Profile.

- Fill in a ZIP Code field for SureTax, Avalara, or Compliance Solutions calculation of non-calls charges: packages and extra charges.

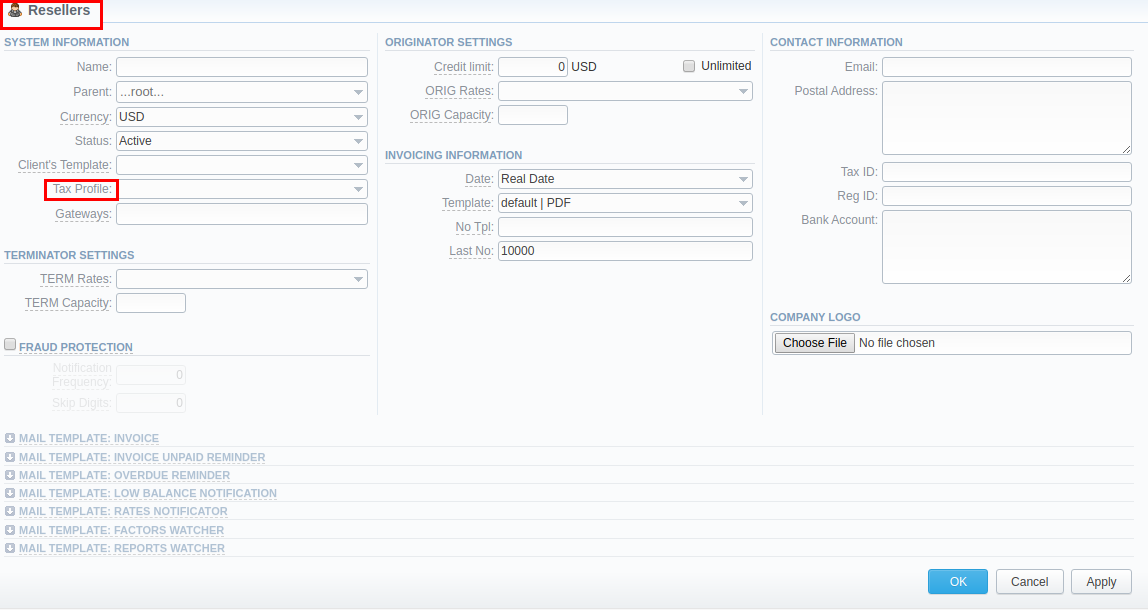

Taxes profile for multi-level billing

If you need multi-level billing for your Resellers, you can set it up by going to Management → Resellers and assigning a Taxes Profile (see the screenshot below).

To get more details about multi-level billing, check out the following article: What is resellers billing mode?

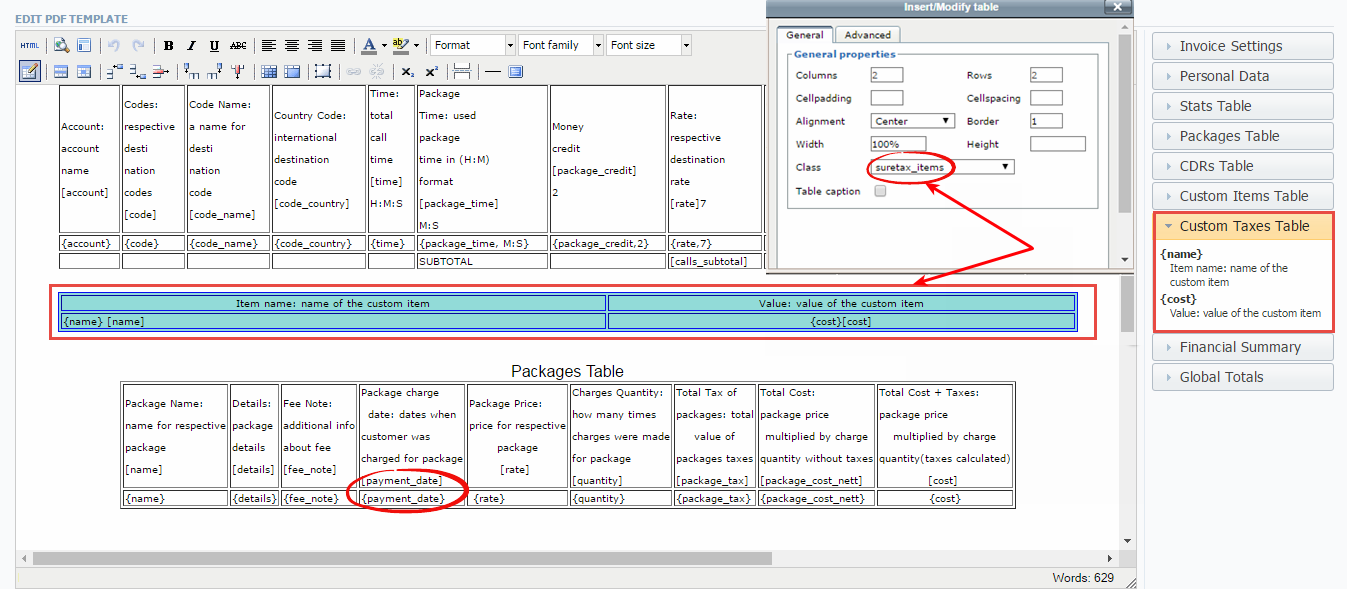

Invoice templates configuration

- Open the Invoice Templates section.

- Create a new invoice template or edit an existing one.

- Add an addition Custom Taxes table with

nameandcostvariables. - Go to table Class in the Properties by right mouse clicking. Input

custom_taxesmanually in the Class field. - In case you have Packages for the Client, put in the

payment_datevariable to the Packages table.

note

- For proper usage of SureTax, Avalara, or Compliance Solutions, Dst and Src Numbers must be in NPANXXNNNN (10 digits) format for calls, and a correct ZIP code must be specified in the client's setting for non-calls charges.

- Please note that you cannot change the Taxes Profile type after the profile creation is completed.

- When you specify SureTax, Avalara, or Compliance Solutions as a client's tax profile, the taxes will be only calculated while invoicing. Respective taxes will not be shown in the Transactions section. Once you have created an invoice, a request to the third-party tax calculation engine was sent and taxes would be displayed in the invoice. Only after this, an additional charge will appear in the list of transactions.

- In addition, note that third-party Taxes Profiles do not allow manual tax values management as they will be dipped from the tax calculation engines.