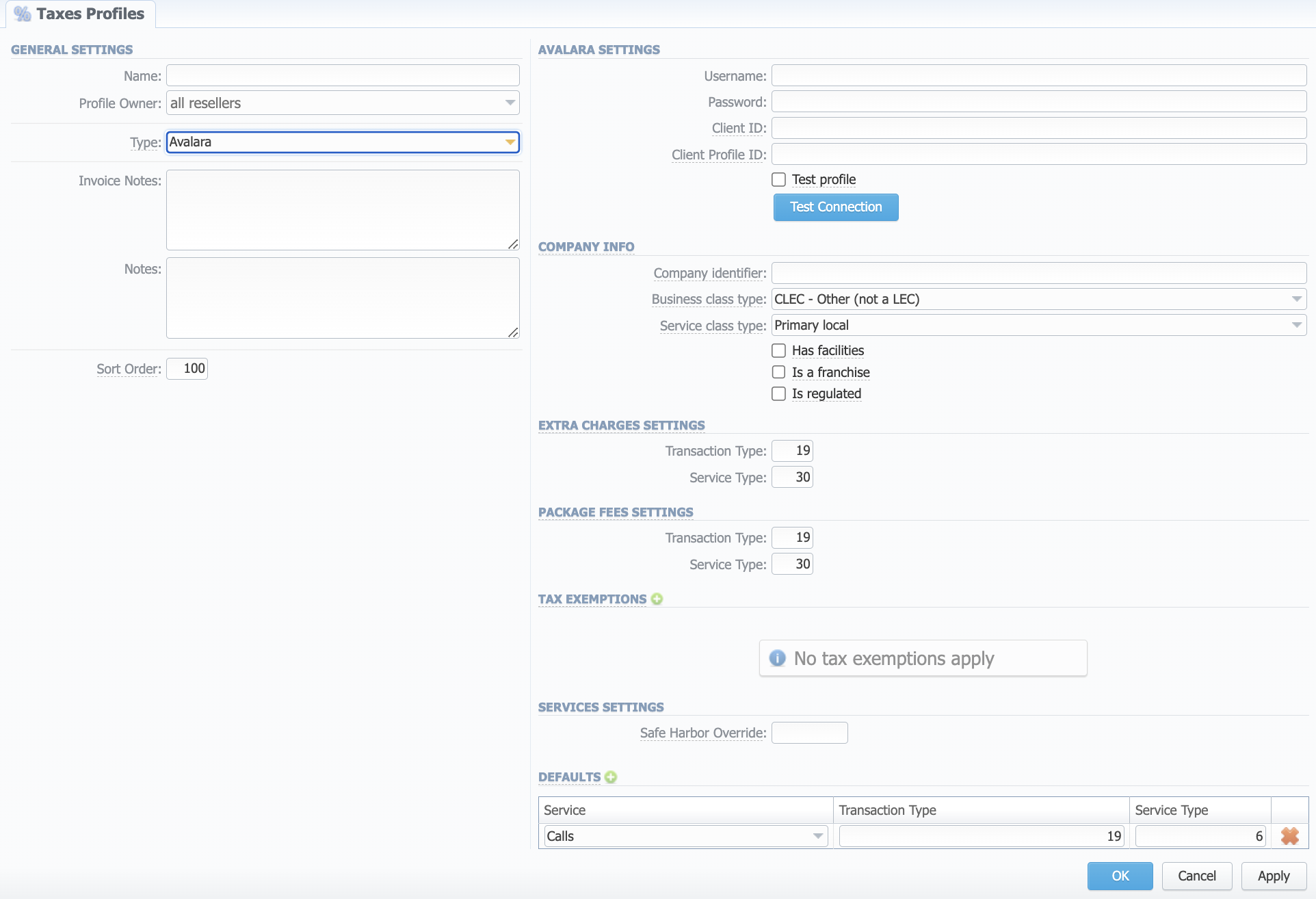

Avalara

This section provides an overview of options available for the configuration of the Avalara tax service provider.

Please refer to Taxes Profiles section of the User Guide for all general parameters.

General settings

- Type – select "Avalara"

Avalara settings

- Username – company username in Avalara

- Password – company's password in Avalara

- Client ID – unique identifier of your company provided by Avalara

- Client Profile ID – Avalara Profile ID you want to use (leave empty for default configuration)

- Test profile – mark to specify that the profile is a test one

- Test connection button – click to check if your specified Avalara username/password is correct and if there is a connection setting up to Avalara with the specified credentials

Company info

Additional information about your company that will be used for tax calculation:

- Company Identifier – optional setting which will be used in reporting

- Business class type – this setting refers to your company's regulatory status for local exchange carriers:

- ILEC

- CLEC - Other (not a LEC)

- Service class type – whether your company generates more revenue primarily from local or long-distance calls:

- Primary local

- Primary long distance

- Has facilities checkbox – indicates whether your company has company-owned facilities to provide the service

- Is a franchise checkbox – indicates whether your company provides services sold pursuant to a franchise agreement between the carrier and jurisdiction

- Is regulated checkbox – indicates whether your company is regulated by state public utility regulators

Extra charges settings

This section defines default settings for Extra Charges taxation:

- Transaction Type – Transaction Type for the Extra Charges

- Service Type – Service Type for the Extra Charges

You can also set separate Codes per Extra Charge if needed. For this, when creating an Extra Charge in Transactions, add a Tag, specifying both Transaction Type and Service Type, e.g. avalara:19-30.

Package fees settings

This section defines default settings for Packages Fees taxation:

- Transaction Type – Transaction Type for the Package Fees

- Service Type – Service Type for the Package Fees

You can also set separate Codes per Package Fee if needed. For this, when adding a Fee to a Package, set a Tag, specifying both Transaction Type and Service Type, e.g. avalara:19-30.

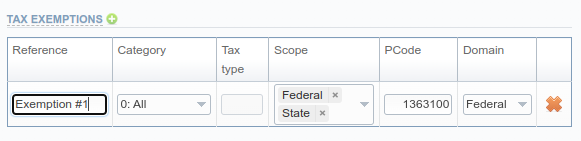

Tax exemptions

Click the "add" button to add a tax exemption to exclude certain taxes or groups of taxes when generating invoices:

- Reference – Name of an exemption

- Category – Choose one Tax Exemptions Category among the following:

- 0: All

- 1: Sales and use taxes

- 2: Business taxes

- 3: Gross receipts taxes

- 4: Excise taxes

- 5: Connectivity charges

- 6: Regulatory charges

- 7: E-911 charges

- 8: Utility user taxes

- 9: Right of way fees

- 10: Communications services tax

- 11: Cable regulatory fees

- 12: Reserved

- 13: Value added taxes

- Tax Type – Fill in the tax type for an exemption

- Scope – Specify needed scope(s):

- Federal

- State

- County

- City

- PCode – Specify an exact PCode for this type of exemption

- Domain – Choose one domain among the following:

- Federal

- State

- County

- City

Services settings

- Safe Harbor Override – specify a numeric value to set static traffic distribution between interstate/intrastate

The Safe Harbor logic applies to transactions for services only (i.e., calls). Fill in this field to request an override of the standard static distribution. If the field is empty, defined static distribution will be used.

Defaults

This section defines default settings for Services taxation:

- Service – set a Service for which rule should be applied (e.g. Calls, SMS, Data)

- Transaction Type – Transaction Type for the Service

- Service Type – Service Type for the Service